Is an Interest-Only Home Loan Right for You?

Pros and Cons Explained Interest-only home loans can

Redefining home loans is part of who we are, and it means real savings for you. We’ve already helped thousands of Australians save a collective $704 million—and the numbers keep growing.

Easily unlock your home’s equity and boost your borrowing power.

Switch your loan type, adjust repayment frequency, or top-up when needed—completely free with our Straight Up and Power Up loans.

With our flexible offset accounts, you can manage your savings effectively while benefiting from our Power Up loan. The more funds you deposit into your offset, the lower your interest payments will be, helping you save even more over the life of your loan. Enjoy the freedom to maximize your savings while reducing your loan costs!

Tailor your split loans across fixed, variable, owner, investor, P&I, and IO, or choose different loan terms (up to 10 years). Consolidate up to four debts under one interest rate.

We offer a variety of loans tailored to every borrower, including homeowners, investors, and those needing specialized options for construction, self-employment, or bridging loans. If you’re facing unique challenges, we’re here to help.

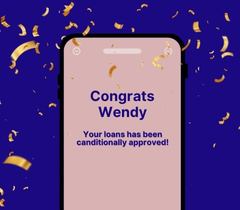

If we can’t secure a loan for you, we’ll connect you with someone who can. Count on us to handle the search, paperwork, and negotiations on your behalf!

Whether you’re looking for something straightforward or more complex, we have the perfect loan with competitive rates for your property.

Repayment Type

Our hassle-free, low-rate variable loan.

Feature packed, super flexible variable loan

Get repayment certainty by fixing your rate

Opt for an Credit Star loan with zero fees and save up to $8,650 compared to other lenders. Use those savings to pay off your loan faster!

With AcceleRATES, the more you pay off your loan, the lower your interest rate gets—automatically!

At Credit Star, all customers get the same low rate on comparable loans—no higher rates for loyal customers like other lenders. Fair and square!

Reduce your interest by crediting your salary into an offset account. Set up multiple offsets to organize your savings goals and save even more.

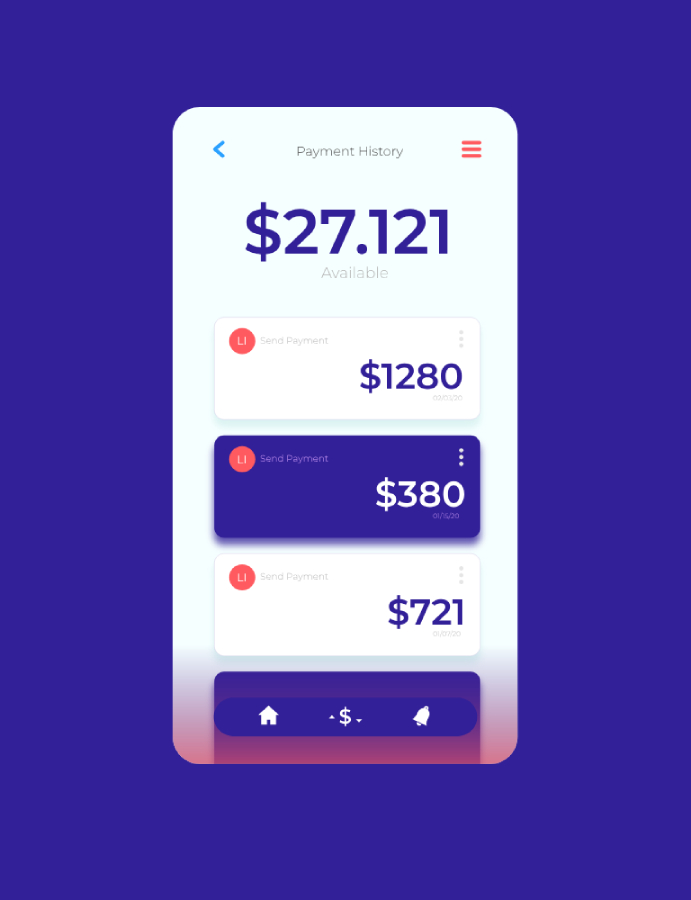

Lower your repayments by switching to our competitive interest-only rates without any monthly fees. This allows you to enhance your cash flow.

Transfer your debts to your home loan at a lower interest rate, helping you save on both repayments and overall interest.

We don’t impose any charges when you adjust your Straight Up or Power Up home loan, setting us apart from many other lenders.

Get your repayment and savings estimates in just 3 minutes. Complete your online application in 15 minutes, needing only as few as two payslips.

Contact your dedicated Aussie-based Loan Expert via SMS, live chat, or phone to finalize your deal.

We’ve simplified the process, reducing time, paperwork, and hassle. Obtain a fast quote and take the first step toward homeownership!

Evaluate your existing loan, determine your eligibility, and estimate your repayments—all without any credit checks!

Our online application takes just 15 minutes and delivers a decision in 60 seconds.

After approval, simply review and return your documents, and we'll ensure you get settled and start saving quickly.

Join the many satisfied customers of Credit Star and read their experiences on Google Reviews.

EXCELLENTTrustindex verifies that the original source of the review is Google. I only have positive things to say about the professionals at Credit Star Co Home Loans. Guided us step by step throughout the process of purchasing our home. Harbir is very knowledgeable and experienced, from home loan application to working with banks to get you the right loan and interest rate was smoothly handled. Guys at Credit Star Co Home Loans are 10 out of 10.Trustindex verifies that the original source of the review is Google. Mr. Harbir provided an outstanding assistance in securing the best mortgage deal for us. He connected us with the most suitable bank and ensured everything was completed on time. His helpfulness and professionalism were evident throughout the entire process. With diligent follow-ups and meticulous attention to detail, Harbir handled every aspect of our mortgage application seamlessly. Thanks to his dedication and the hard work of his team, we are now happily settled in our new home. We highly recommend Harbir to anyone seeking a dedicated and efficient service.Trustindex verifies that the original source of the review is Google. Massive thanks to Harbir and his team to help me getting my first home.Harbir and team were always there to help me guiding all steps smoothly, Harbir always answers my call no matter what the time was of the day, I would like say credit star co home loans team are very professional and efficient and effective Highly Recommended. Keep up the awesome work team credit star 🌟🌟🌟🌟🌟🌟Trustindex verifies that the original source of the review is Google. It was great working through my slightly complex mortgage application for multiple mortgages with Harvie and Credit Star. I couldn't have asked for a more patient and professional broker supported by a very capable team. Harbir was able to get me approval at a time I had given up on traditional lenders and other brokers. While the higher interest rate that I accepted was not fun, it was definitely a trade-off I was willing to make to keep my investment property. Harbir was the only one able to get me a satisfactory outcome (in raw words get me approved) when two other brokers and traditional lenders couldn't. I would recommend Harbir and Credit Star to anyone looking for a decent and capable broker, especially those with complex financial standing. Thanks Harbir!!Trustindex verifies that the original source of the review is Google. Harbir and his team helped me through the process of buying my first home!! They worked absolute miracles and made the process extremely smooth. Buying your first property can be extremely daunting and for me came with so many unknowns!! But throughout it was always made sure that I had a clear understanding of what the process was, and I never felt left in the dark. Once I had settled in my home they continued to check in on me and have helped me through many other processes, ie new interest rates. I will forever be recommending Harbir and his staff to everyone wanting to purchase or refinance a propertyTrustindex verifies that the original source of the review is Google. Harbir and his team have been there for us through the entirety of our journey finding a place we can call home. He's been diligent, approachable and accommodating in helping us understand and navigate the murky waters of the financing world. Our many thanks to Harbir and the team at Credit Star for helping us lock in our dream home!Trustindex verifies that the original source of the review is Google. Navigating the process and acquisition of a home loan or refinancing is never an easy task. However with Credit Star, it felt effortless with great communication, easy document submission system. I highly recommend their first class service with a 101% successful outcomes. Thanks for your service and keep up the good work!!!!!Trustindex verifies that the original source of the review is Google. Buying a first home can always be overwhelming and an area of lots of unknows. This was something we were concerned about but being with Harbir changed everything. I had contacted 3 Loan Specialists before, but Harbir had the dedication to meet us face to face and explain everything in detail about how a home loan in Australia works. He took a lot of time out to explain all financial terms of buying a property which I did not experience with any other Loan Specialist that I had contacted. The communication with Harbir and his team was very prompt and informative. They would do everything to meet deadlines and kept the process going forward. I would say working with their team to be very efficient and professional. As I was buying my first home around Christmas, most financial brokers could not commit to when they could get my loan approved. Harbir, got my loan approved in less than 5 business days during that time which seemed to be an impossible task. I would also like to highlight that at the time I believe I had got one of the lowest interest rates deals. Harbir provides exceptional service providing the right advise and keeping the clients interest first. I would be happy to recommend Harbir and his services to anyone.Trustindex verifies that the original source of the review is Google. If you are looking for a home loan, then one person stands out from the crowd that is Harbir and his team. Very knowledgeable and professional. Overall process was very seamless and we got approvals for 2 loans within a week. Highly recommended to future home loan seekers!Verified by TrustindexTrustindex verified badge is the Universal Symbol of Trust. Only the greatest companies can get the verified badge who has a review score above 4.5, based on customer reviews over the past 12 months. Read more

Our Australian-based Loan Experts are ready to assist you. Whether by phone, SMS, or live chat, you can reach out with your questions, and they’ll even guide you through the application process.

Pros and Cons Explained Interest-only home loans can

A property investment game plan is about setting

Cross-collateralisation can be a powerful tool for property

You can apply in just 15 minutes. Our loan experts will reach out to guide you through the process.

We’ll handle the valuation and ID verification, which may take a few days. After that, we’ll send a transfer request to your current lender. Please note that delays can occur here, especially if your current lender tries to retain you. Generally, switching can take around 2-3 weeks, but on average, our customers complete the process in about 6 weeks. We’ll keep you updated throughout!

To be eligible for refinancing with Credit Star, you’ll need to meet specific financial criteria, including credit history, income, and property valuation. Our team can help assess your individual situation.

Your AcceleRATE tier will be determined based on your loan amount and repayment history. Our experts will clarify this during the application process.

Yes, you can refinance multiple properties. Each application will be assessed individually for the best outcomes.

Absolutely! You can refinance to release equity from your property for other investments or expenses.

Yes, refinancing to consolidate debt is an option. We can assist in merging your existing debts into a single, manageable loan.

Valuations are conducted by accredited professionals to determine your property’s current market value, essential for refinancing.

Typically, switching takes around 6 weeks, though this can vary. Our team will keep you informed throughout the process.

It depends on your current lender’s policies. You may face exit fees, so it’s best to check your loan agreement.

CREDIT REPRESENTATIVE 506564

BLSSA Pty Ltd ACN 117 651 760 (Australian Credit Licence 391237)

With AcceleRATES, we’ll reduce your rate as you pay down your Straight Up or Power Up home loan.

At Credit Star, we ensure both new and existing customers enjoy the same competitive rates for comparable loans with our Automatic Rate Match.

Our Straight Up and Power Up loans come with absolutely no Credit Star fees!

Get lightning-fast refinancing to help you reach your goals sooner.

Apply online in just 15 minutes and receive a decision in seconds.

Connect with our Home Loan Experts by phone or text—they can even handle your application for you!

Our flexible policies allow you to borrow more with ease.

Use the extra funds for renovations or investing in another property.

Find out how much you can borrow in just 3 minutes!

Have questions or need help with your application? Our Aussie Loan Experts are ready to assist.

Weekdays 9am – 5pm AET